Contribution margin (presented as a % or in absolute dollars) can be presented as the total amount, amount for each product line, amount per unit, or as a ratio or percentage of net sales. By multiplying the total actual or forecast sales volume in units for the baseball product, you can calculate sales revenue, variable costs, and contribution margin in dollars for the product in dollars. Selling price per unit times number of units sold for Product A equals total product revenue. With a traditional income statement, you begin with revenue, then subtract cost of goods sold (which includes both variable and fixed production costs) to arrive at gross profit. Then you subtract selling and administrative expenses (both fixed and variable) to arrive at operating income.

Contribution margin is not intended to be an all-encompassing measure of a company’s profitability. However, contribution margin can be used to examine variable production costs. Contribution margin can also be used to evaluate the profitability of an item and calculate how to improve its profitability, either by reducing variable production costs or by increasing the item’s price. For an example of contribution margin, take Company XYZ, which receives $10,000 in revenue for each widget it produces, while variable costs for the widget is $6,000. The contribution margin is calculated by subtracting variable costs from revenue, then dividing the result by revenue, or (revenue – variable costs) / revenue.

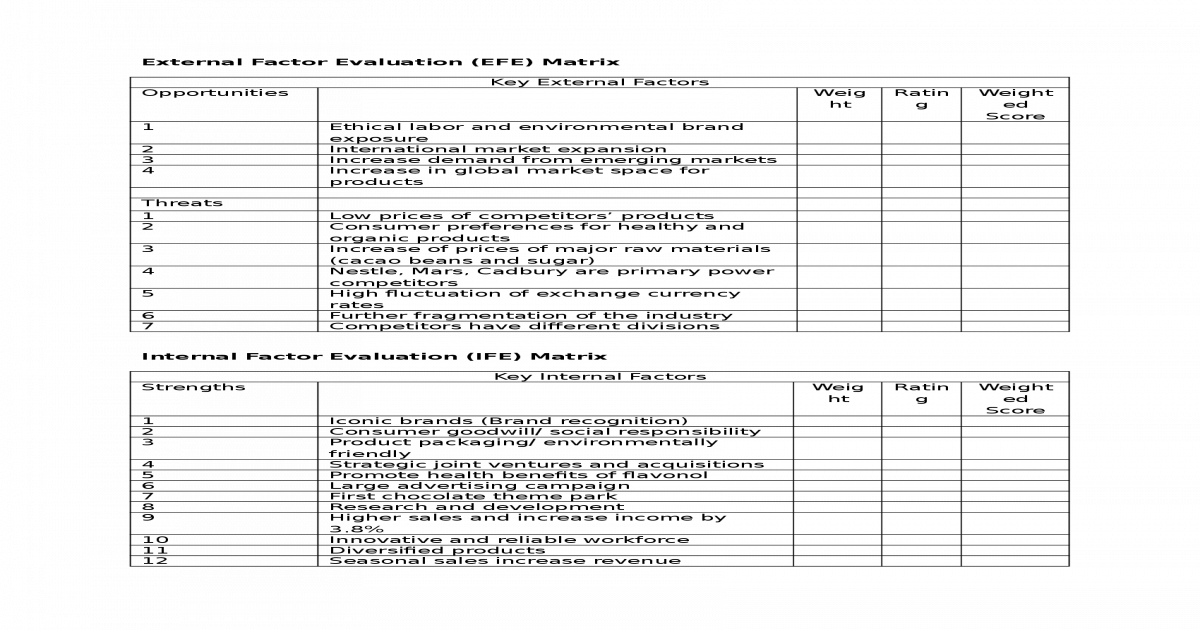

Contribution Margin Income Statement

She is a former CFO for fast-growing tech companies with Deloitte audit experience. Barbara has an MBA from The University of Texas and an active CPA license. When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. Try Shopify for free, and explore all the tools and services you need to start, run, and grow your business. To get a better sense of what this all means, let’s take a more detailed look at the formula components.

- The contribution margin per hour of OR time is the hospital revenue generated by a surgical case, less all the hospitalization variable labor and supply costs.

- Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies.

- Fixed costs are those costs that will not change within a given range of production.

- Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income.

- When comparing the two statements, take note of what changed and what remained the same from May to June.

Knowing your company’s variable vs fixed costs helps you make informed product and pricing decisions with contribution margin and perform break-even analysis. As a company becomes strategic about the customers it serves and products it sells, it must analyze its profit in different ways. Gross margin encompasses all costs of a specific product, while contribution margin encompasses only the variable costs of a good. While gross profit is more useful in identifying whether a product is profitable, contribution margin can be used to determine when a company will breakeven or how well it will be able to cover fixed costs. This demonstrates that, for every Cardinal model they sell, they will have $60 to contribute toward covering fixed costs and, if there is any left, toward profit.

Uses of Contribution Margin

Analyzing a product’s contribution margin and break-even point provides information on the company’s operational efficiency. These two measurements also give business owners information on pricing. Once you know the profit (or loss) a product is generating, you can begin to analyze and adjust prices accordingly. Because your gross profit percent % shows how effective you are in running your business. It tells you if you’re pricing your jobs right – the most important decision every business owner will make. Calculating the contribution margin for each product is one solution to business and accounting problems arising from not doing enough financial analysis.

Most business owners think all variable costs are above the line and stop at gross profit. But if you want to know your break-even point, you have to take it one step further and subtract the below the line costs that are variable (e.g. sales commissions). As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs.

Different Levels of Transparency

Where C is the contribution margin, R is the total revenue, and V represents variable costs. The lower your contribution margin, the more difficult it is for your business to cover your fixed costs. Cutting those costs, such as by relocating into less expensive space or eliminating non-essential positions, is one way to improve your financial position.

You should also consider whether your products will be successful in the market. Just because the break-even analysis determines the number of products you need to sell, there’s no guarantee that they will sell. A business’s break-even point is the stage at which revenues equal costs. Once you determine that number, you should take a hard look at all your costs — from rent to labor to materials — as well as your pricing structure. One common way to use contribution margin per unit is to find a business’s “breakeven point”—the number of units the business would have to sell in order to precisely break even in a given period.

What Is the Difference Between Contribution Margin and Profit Margin?

The contribution margin income statement shown in panel B of Figure 5.7 “Traditional and Contribution Margin Income Statements for Bikes Unlimited” clearly indicates which costs are variable and which are fixed. Recall that the variable cost per unit remains constant, and variable costs in total change in proportion to changes in activity. Thus total variable cost of goods sold is $320,520, and total variable selling and administrative costs are $54,000. These two amounts are combined to calculate total variable costs of $374,520, as shown in panel B of Figure 5.7 “Traditional and Contribution Margin Income Statements for Bikes Unlimited”.

However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs). For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s. Since machine and software costs are often depreciated or amortized, contribution is equal to sales minus these costs tend to be the same or fixed, no matter the level of activity within a given relevant range. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. In general, a higher contribution margin is better as this means more money is available to pay for fixed expenses.

Contribution margin as a measure of efficiency in the operating room

The contribution margin ratio of a business is the total revenue of the business minus the variable costs, divided by the revenue. Also, it is important to note that a high proportion of variable costs relative to fixed costs, typically means that a business can operate with a relatively low contribution margin. In contrast, high fixed costs relative to variable costs tend to require a business to generate a high contribution margin in order to sustain successful operations. The variable costs to produce the baseball include direct raw materials, direct labor, and other direct production costs that vary with volume.

This allocation of fixed overhead isn’t done for internal analysis of contribution margin. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good. This is one of several metrics that companies and investors use to make data-driven decisions about their business. As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.

Group Financial Results as of June 30th 2023, Approved Solid … – Business Wire

Group Financial Results as of June 30th 2023, Approved Solid ….

Posted: Tue, 01 Aug 2023 05:23:00 GMT [source]

Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items. In our example, if the students sold 100 shirts, assuming an individual variable cost per shirt of $10, the total variable costs would be $1,000 (100 × $10).

For example, they can increase advertising to reach more customers, or they can simply increase the costs of their products. However, these strategies could ultimately backfire and result in even lower contribution margins. The contribution margin ratio can be used as a measure of a company’s profitability as well as a measure of how profitable a particular product line is. Evaluating the contribution margin ratio for a certain brand or product can help determine if it makes sense for the company to continue selling it at its current price. The closer a contribution margin percent, or ratio, is to 100%, the better.

- If they send one to eight participants, the fixed cost for the van would be $200.

- However, these strategies could ultimately backfire and result in even lower contribution margins.

- Time Leakage is time YOU are paying for, but you’re not charging the client for.

- Variable costs vary with the volume of activity, such as the number of units of a product produced in a manufacturing company.

- This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced.

- All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit.

Contrary to popular belief, the most important number on a financial statement is not net income – it’s gross profit %. If you want to do more than break-even and make a profit, you should understand your contribution margin. Analyzing your contribution margin is the fastest way to get your business to drive profits. You can use a spreadsheet, such as Google Sheets or Microsoft Excel, to include columns by product, enabling you to compare the contribution margin for each of your business products. Contribution margin analysis is a measure of operating leverage; it measures how growth in sales translates to growth in profits.

For those organizations that are still labour-intensive, the labour costs tend to be variable costs, since at higher levels of activity there will be a demand for more labour usage. Variable costs probably include cost of sales (the cost of goods sold) and a portion of selling and general and administrative costs (e.g., the cost of hourly labor). Retail companies like Lowe’s tend to have higher variable costs than manufacturing companies like General Motors and Boeing.